ADVANTAGES AND DISADVANTAGES GOAL OF STOCK PRICE MAXIMISATION JOURNAL ARTICLE

2 it integrates all the dimensions of the value creation system better than other accounting-based or cash-based metrics. We begin by summarizing the economic rationale behind and the welfare consequences of.

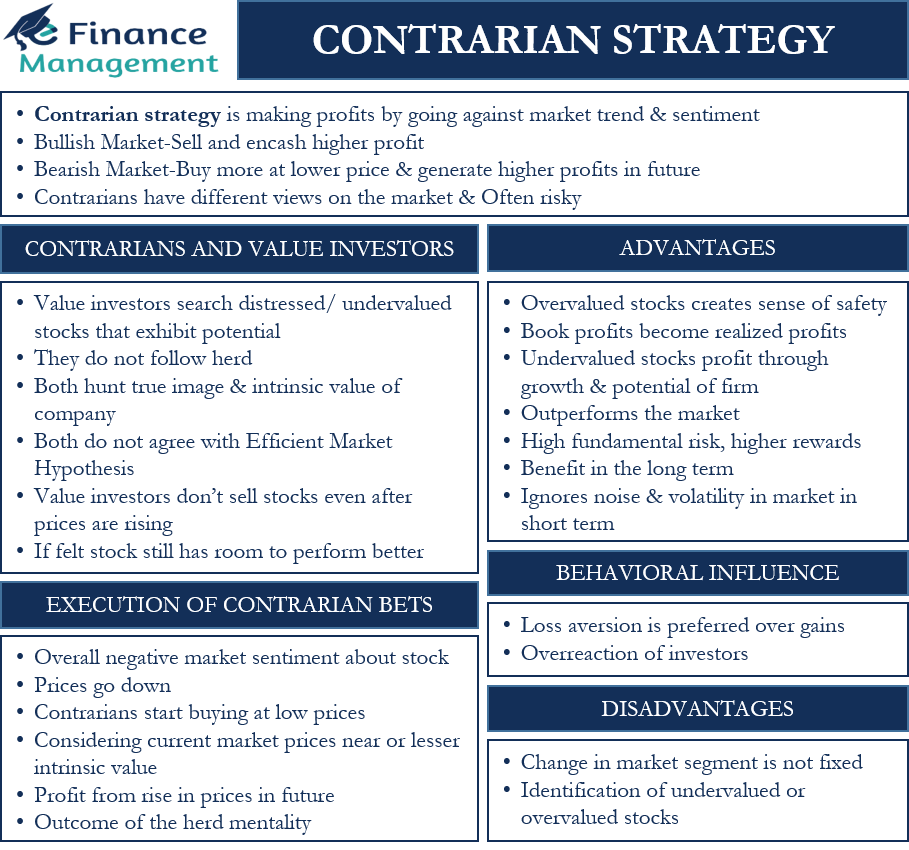

Contrarian Strategy Meaning Execution Advantages And Disadvantages

Capital gains are taxed at low rates.

. As the stock price increases the value of the firm increases as well as the shareholders wealth. The Wall Street Journal - 021699. Profit maximization shouldnt overshadow Shareholder Wealth Maximization as many a times.

It relates net income to investments made in a division giving a better measure of divisional profitability. Stock investment offers plenty of benefits. Price of the stock Reverte Gómez-Melero Cegarra-Navarro 2016.

Meaning of Profit Maximization. The basis for this goal is the belief that the price of the stock is the. While many might agree this principle governs managerial behavior it continues to arouse intense scrutiny adoration and condemnation.

When business managers try to maximize the wealth of their firm they are actually trying to increase the companys stock price. These returns can take the form of periodic dividend payments or proceeds from the sale of the common stock. Comparing Profit Maximization and Wealth Maximization.

In other words the elements of timing and risk must be considered by managers as they make an important financial decision for example capital. How to make your share market investments less risky. Shareholder Wealth Maximization should guide the decision making of the firm which needs to be represented in the common stock price.

Many investors tend to buy a share at a high price out of greed and sell at a low price out of fear. Any financial decision to become effective needs better understanding of organizational goals. Advantages of profit maximization is company can increase their return by boosting up sales or by reducing the cost.

Profit maximization is the ability of a business or company to earn maximum profit with low cost which is considered as the main goal of any business and also considered as one of the objectives of financial management. First profit maximization is vague. He is the true change maker inside a.

Those companies that focus on profit maximization and share holders Tai Chuang 2014. As the economy grows so do corporate earnings. In modern finance it is proven that shareholder wealth maximization is the superior goal of a firm and shareholders are the residual claimants.

Thats because economic growth creates jobs which creates income which creates sales. The microeconomics concept that maximization of profits is the foremost goal of the firm. Hence coffee- can investing is the best strategy to avoid roller coaster investing.

3 the minimum appropriate TSR goal is easy to establish. The three problems associated with using profit maximization as the goal of the firm are the following. Electr onic Journal of.

The study found that the stock market returns indicators dividend per share earnings and Leverage have joint and statistically significant relationship. Advantages Disadvantages and Approaches. Advantages of Profit-Maximization Hypothesis.

The stock prices rise and fall frequently due to volatility. The Unanticipated Risks of Maximizing Shareholder Value. ROI has the following advantages.

Click to see full answer. Why is Maximizing Shareholder Wealth a Better goal. It will be set by.

The shareholder wealth maximization goal states that management should seek to maximize the present value of the expected future returns to the owners that is shareholders of the firm. Disadvantages of Cost Reduction. Extra profit will add value to the company and give them some competitive advantages.

These differences are substantial as noted below. Similarly what are the advantages and disadvantages of profit maximization. What is Profit Maximization.

Therefore maximizing shareholder returns usually implies that firms must also satisfy stakeholders such as customers employees suppliers local communities and the. The essential difference between the maximization of profits and the maximization of wealth is that the profits focus is on short-term earnings while the wealth focus is on increasing the overall value of the business entity over time. Takes advantage of a growing economy.

What are the advantages and disadvantages of firm value maximization as a corporate objective. Better Measure of Profitability. Advantages and Disadvantages of using CSR Standards as A way of Establishing A Responsible Business Group.

The objective of shareholder wealth maximization has a number of distinct advantages. Brief Summary of Article. Profit maximization is a short term objective of the firm and is.

It does not matter that few firms are maximizers in reality. Firstly it explicitly considers the time value of money and risk factors of the benefits expected to receive to the owners. As the earning of the company increases so the share price also increases which helps shareholders to sell shares at a higher price.

So it is beneficial for the shareholders. Sometimes Cost Reduction involves changing. Besides that it is also important to realize that the goal of maximizing shareholder wealth has some advantages.

Shareholder Wealth Maximization 101. The CFO has to become a chief value officer. All divisional managers know that their performance will be judged in terms of how they have utilized.

What is the purpose of the annual meeting. Shareholder primacy forces management to focus on profit maximization which should be the ultimate goal of the management. The employees can mistake it for cost-cutting and send a panic alarm throughout the company.

Maximizing Shareholder Wealth as the Primary Goal. Market valueis defined as the price at which the stock trades in the market place such as on the New York Stock Exchange. 1 it incorporates the value of dividends and other cash pay-outs which can represent anywhere from 20 to 40 or even more of a companys TSR.

Although cost reduction is a positive step towards developing and growing the company in long run it can cause negative vibes throughout the company and amongst the employees. The fatter the paycheck the greater the boost to consumer demand which drives more revenues. Opinions expressed by Forbes Contributors are their own.

Allstate Corporation adopts a takeover defense. If company can produce their goods at cheaper rate than. So the board has to spend more time understanding and then explaining information in clear concise and understandable language so the reader can make an informed assessment.

What are the advantages and disadvantages of stock price maximization as a corporate objective. Return on Investment ROI. 6 Advantages of Stock Investing.

Advantages of using this approach. The view that firms managers behave as if their goal is to increase shareholder wealth is the shareholder-wealth-maximization principle. The Importance of Shareholder Wealth Maximization in Business.

The profit-maximization hypothesis allows us to predict quite well the behaviour of business firms in the real world. I write about 21st century leadership Agile innovation narrative. Thus total shareholder wealth equals the number of shares outstanding times the market price per share.

Profit maximization ignores such differences in value.

Summary Of The Advantages And Disadvantages Of Performance Related Pay Download Table

Summary Of The Advantages And Disadvantages Of Performance Related Pay Download Table

Advantages And Disadvantages Of Forest Taxes And Fees Forest Taxes Download Table

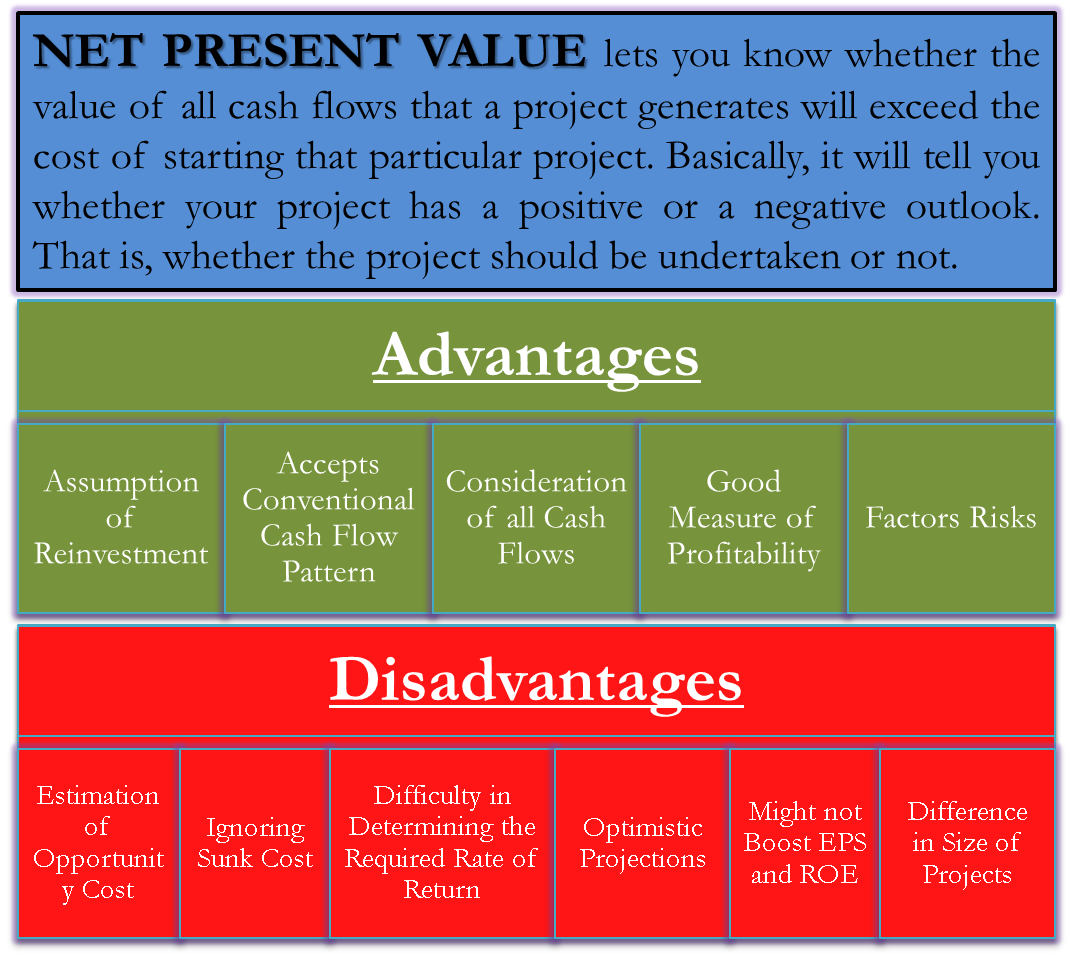

Advantages And Disadvantages Of Npv Net Present Value Examples

Summary Of Lidar Based Slam S Advantages And Drawbacks Download Scientific Diagram

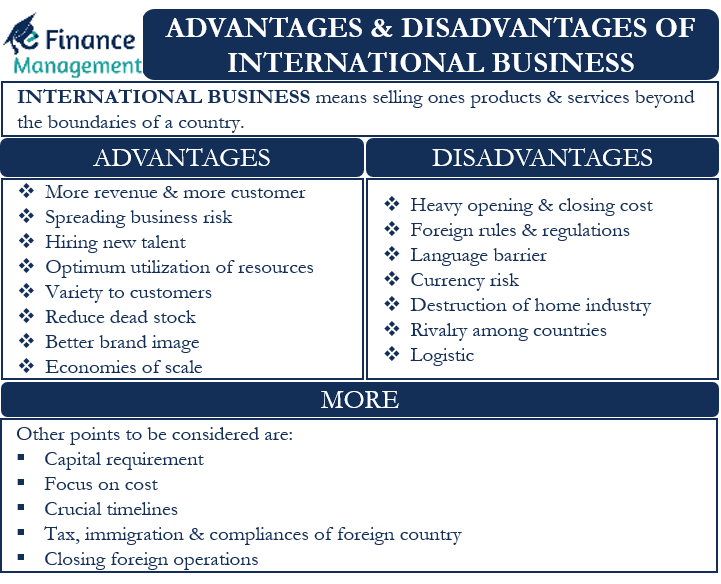

Advantages And Disadvantages Of International Business

Advantages And Disadvantages Of Server Based Privacy Protection Download Table

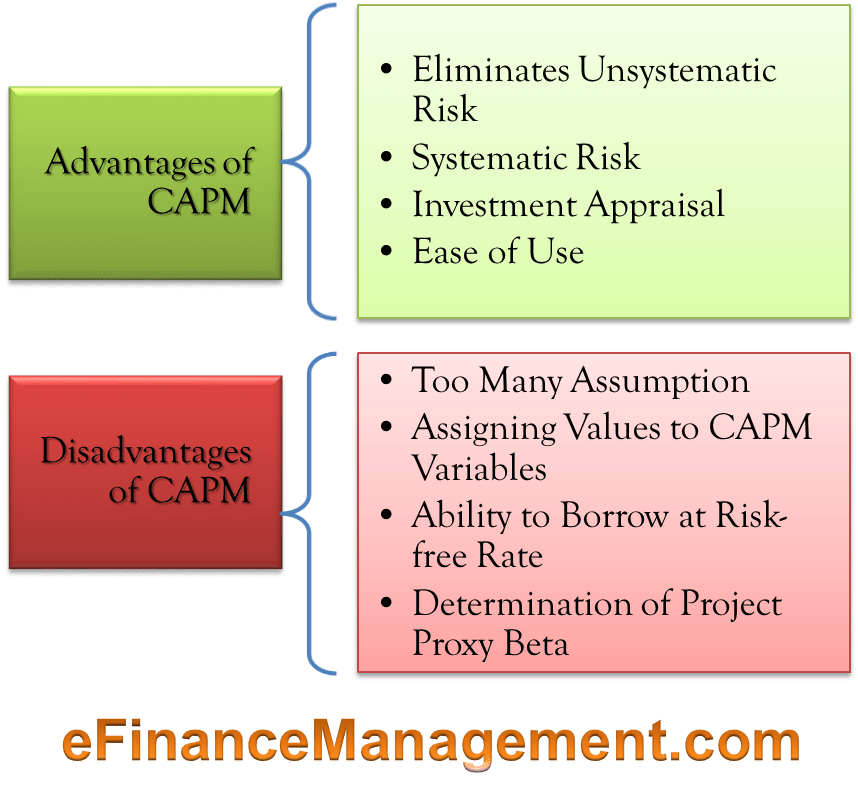

Advantages Disadvantages Of Capm Efinancemanagement

Comparing Advantages And Disadvantages Of Different Control Methods Download Scientific Diagram

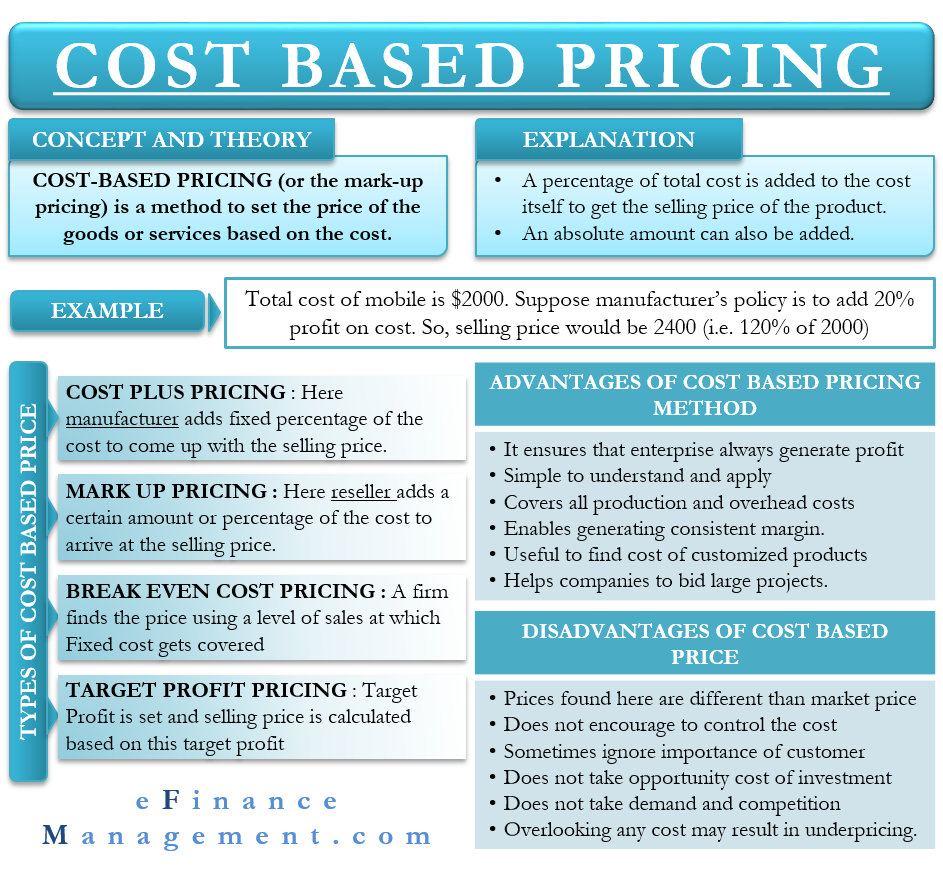

Cost Based Pricing Meaning Types Advantages And More

Chapter 16 Pricing Concepts Ppt Download

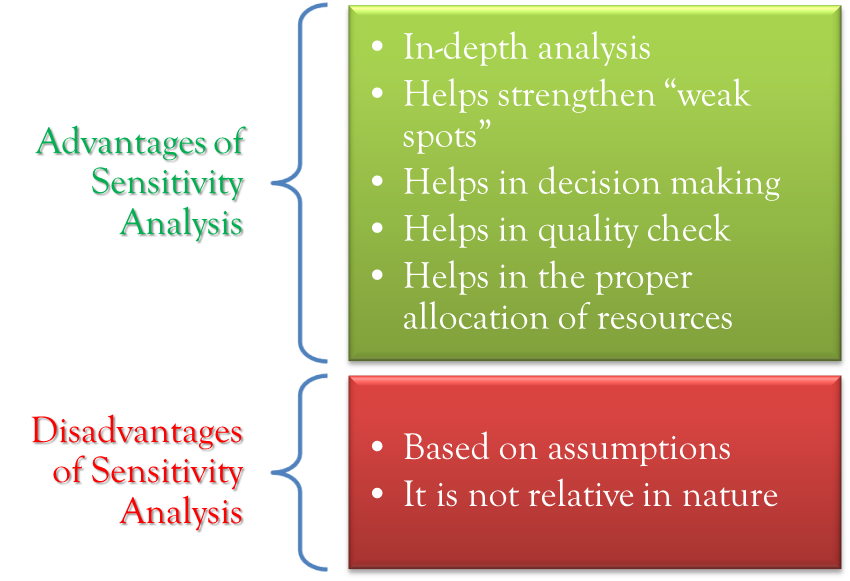

Advantages And Disadvantages Of Sensitivity Analysis Efm

Comparing Advantages And Disadvantages Of Different Control Methods Download Scientific Diagram

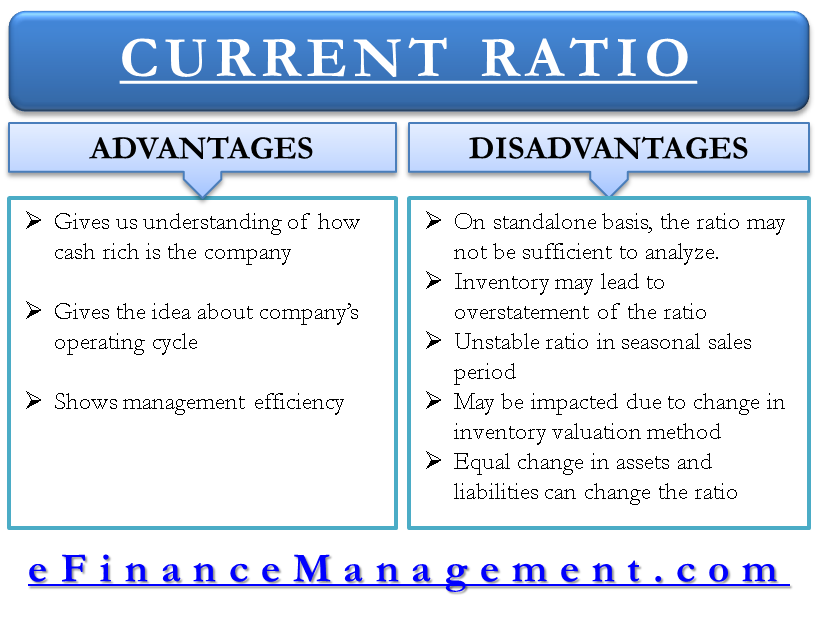

Advantages And Disadvantages Of Current Ratio

Advantages And Disadvantages Of Net Present Value Npv Efm

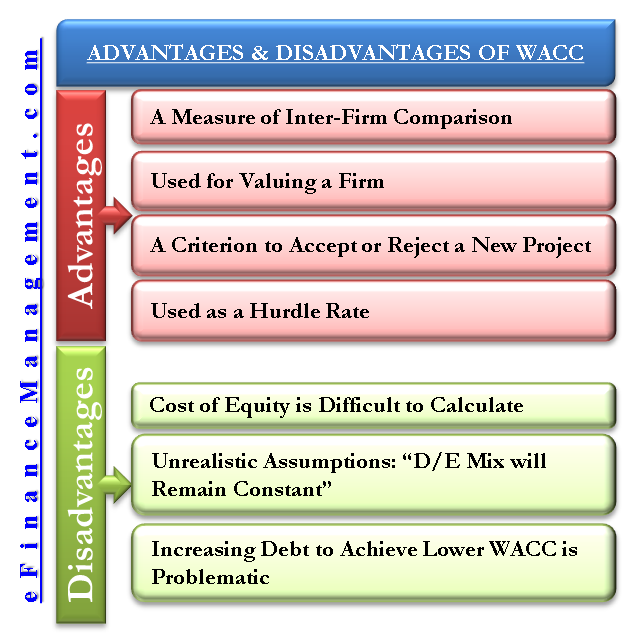

Advantages Disadvantages Of Weighted Average Cost Of Capital Wacc

Comparative Advantage Comparative Advantage Financial Management Financial Analysis

Summary Of The Advantages And Disadvantages Of Performance Related Pay Download Table

Comparison Of The Advantages And Disadvantages Of Fund And Flow Elements Download Scientific Diagram

0 Response to "ADVANTAGES AND DISADVANTAGES GOAL OF STOCK PRICE MAXIMISATION JOURNAL ARTICLE"

Post a Comment